Four decades ago, the land at Exit 16 of the New York State Thruway looked nothing like the sprawling retail destination that draws 13 million shoppers annually today. Woodbury Common Premium Outlets transformed not just 130 acres in Central Valley—it reshaped Orange County’s entire economic landscape. This is the story of how a single development became New York’s most powerful tourism magnet outside Manhattan.

Before Woodbury Common: The Pre-1985 Landscape

In the early 1980s, the Woodbury area existed primarily as agricultural land and scattered residential properties. The town itself—comprising the hamlets of Central Valley and Highland Mills—maintained its rural character. Local industry centered on traditional manufacturing, including the historic Payne and Leonard Rod Companies that made Woodbury a center for fly rod production.

The location at the intersection of Route 32, Route 17, and the New York State Thruway Exit 16 held strategic value, positioned 45 miles north of New York City in the Hudson Valley corridor. But in 1985, no one could have predicted what would rise from these fields.

1985: The Opening That Changed Everything

Woodbury Common Premium Outlets opened in late 1985 as one of the first major outlet developments in the Northeast. The original center represented a bold bet on the emerging outlet retail concept—designer and name-brand merchandise sold at discount prices in a dedicated shopping center rather than scattered factory stores.

The timing proved perfect. The mid-1980s saw rising interest in value shopping combined with brand consciousness. The location—accessible from New York City via the Thruway, positioned between the growing Hudson Valley tourist destinations—captured both day-trippers and vacationers.

The Simon Connection: The development came from Melvin Simon & Associates (now Simon Property Group), a company founded by brothers Melvin and Herbert Simon in Indianapolis in 1960. By the 1980s, Simon had established itself as one of America’s largest shopping center developers, opening three or more enclosed malls annually. Woodbury Common represented their expansion into the outlet concept that would later become a cornerstone of their portfolio.

The Growth Years: Expansions That Built an Empire

1993: First Major Expansion

Just eight years after opening, Woodbury Common underwent its first significant expansion. The addition demonstrated the center’s early success and Simon’s commitment to scaling the concept. New retail space brought additional brands and increased shopping capacity to handle growing visitor numbers.

1998: Establishing Dominance

The 1998 expansion pushed Woodbury Common beyond 800,000 square feet of retail space with more than 200 stores. This growth period coincided with Simon Property Group’s public offering in 1993 and subsequent aggressive expansion strategy. By the late 1990s, Woodbury Common had established itself as not just a regional destination but an international shopping landmark.

Tour buses from New York City became a regular sight. International tourists—initially dominated by Japanese visitors, later overtaken by Chinese shoppers—began making Woodbury Common a required stop on their American itineraries.

2011-2015: The Parking Deck Era

By 2011, Woodbury Common faced a luxury problem: overwhelming success created parking nightmares and traffic gridlock, particularly during peak shopping periods. Simon announced a $100 million expansion plan that would fundamentally address these issues while adding retail capacity.

The project included:

- A three-level, state-of-the-art parking garage with smart lighting system (red/green indicators directing drivers to available spaces)

- 60,000 square feet of new retail space

- Updated store facades

- Internal traffic flow improvements

The parking deck opened in August 2015, coordinated with New York State improvements to the Thruway interchange. The project created 400 construction jobs and projected 350-400 permanent retail positions.

2018: Market Hall and Beyond

The most recent major renovation completed in 2018 brought the center to its current configuration: more than 250 stores across 912,000 square feet. The crown jewel of this expansion was Market Hall—a new entrance building featuring an updated food court that replaced the limited dining options of earlier eras.

This expansion reflected changing shopper expectations. Modern outlet visitors spend more time on-site (often 3-4 hours) and demand better dining options beyond fast food. Market Hall addressed this shift with higher-quality food vendors and comfortable seating areas.

2024: The Luxury Evolution

In April 2024, Simon Property Group announced the most ambitious expansion since the parking deck project—a multi-million-dollar initiative adding over 20 new stores and restaurants plus 155,000 square feet of additional retail space. This expansion signaled Woodbury Common’s continued evolution toward ultra-luxury retail.

The 2024 expansion brought:

New luxury retailers:

- David Yurman – High-end jewelry

- Roberto Cavalli – Italian luxury fashion

- Maison Margiela – Contemporary avant-garde designs

- BOGNER – Premium sportswear

- Sferra – Luxury home linens

- Jil Sander – Minimalist luxury

- Eleventy – High-end Italian menswear

- Reformation – Sustainable fashion

Enhanced dining:

- Ladurée – French patisserie (famous for macarons)

- Bollicine & Co. – Champagne bar with small plates

Brand expansions: Existing retailers including Tory Burch, Arc’teryx, Marc Jacobs, and Golden Goose expanded their footprints to offer larger product selections.

VIP Suite: A new concierge-level service center opened in the Adirondacks District, offering private lounges, personalized shopping assistance, and event spaces for high-end clientele.

Future infrastructure: Plans include a 200-room hotel (projected late 2025/early 2026 completion), expanded parking facilities, and family play areas—transforming Woodbury Common from day-trip destination to potential overnight resort experience.

The 2024 expansion represents a strategic shift. While previous expansions focused on scale and capacity, this phase emphasized ultra-luxury brands and experiential amenities. The addition of champagne bars and French patisseries signals Woodbury Common’s positioning not just as discount shopping but as upscale retail destination.

Visitor response proved overwhelmingly positive, with reviews averaging 4.5 out of 5 stars. Shoppers particularly praised the addition of sustainable brands like Reformation and the elevated dining options. The only consistent feedback: increased crowds—viewed by most as validation of the expansion’s success.

The Premium Outlets Evolution

Understanding Woodbury Common’s history requires context about Simon Property Group’s broader outlet strategy. In 2004, Simon acquired Chelsea Property Group for $3.5 billion, bringing the established Chelsea Premium Outlets brand into Simon’s portfolio. This acquisition formalized what would become the “Premium Outlets” concept—upscale outlet centers positioned in tourist destinations.

Woodbury Common was rebranded as “Woodbury Common Premium Outlets,” aligning it with Simon’s growing international network. The Premium Outlets platform now includes dozens of locations worldwide, but Woodbury Common remains the flagship—the largest and most visited in the United States.

Economic Impact: Orange County’s “Cash Cow”

Orange County officials don’t hide their appreciation for Woodbury Common. County leaders have publicly referred to the center as the county’s “cash cow,” acknowledging its massive contribution to local finances.

By the numbers (current data):

- 13 million annual visitors (Orange County’s largest tourism draw)

- Sales tax revenue: Clothing and footwear sales generate significant portions of Orange County’s budget, helping keep property tax rates at levels “not seen since the 1960s” according to county officials

- Property tax base: Major contributor to the Monroe-Woodbury Central School District

- Employment: Thousands of retail jobs plus indirect employment in transportation, hospitality, and support services

- Tourism multiplier: Visitors to Woodbury Common support hotels, restaurants, gas stations, and other businesses throughout Orange County

Orange County’s total tourism spending reached $1.196 billion in 2023, with Woodbury Common representing a substantial portion. The center functions as Orange County’s tourism anchor—many visitors who come for shopping extend their stays to explore Bear Mountain, West Point, wineries, and other regional attractions.

The International Phenomenon

What distinguishes Woodbury Common from typical American shopping centers is its international draw. Walk through on any given day and you’ll hear Mandarin, Japanese, Spanish, Portuguese, French, and numerous other languages.

The infrastructure reflects this global clientele:

- Staff interpreters: On-site translation services in multiple languages

- Currency exchange: Available at information centers

- International shipping: Direct shipping services to foreign destinations

- Tour bus accommodations: Dedicated parking and arrival areas

- Daily shuttle service: Multiple companies operate regular routes from Manhattan hotels

The international visitor demographic shifted notably over the decades. Japanese tourists dominated in the 1990s and early 2000s. By the 2010s, Chinese visitors became the largest international group, reflecting China’s economic growth and expanded middle class. Today, the center attracts shoppers from across Asia, South America, Europe, and the Middle East.

For many international tourists, Woodbury Common represents a unique American experience—luxury brands at prices unavailable in their home countries, combined with the American outlet shopping culture they’ve heard about.

The Traffic Challenge: Growth’s Double-Edged Sword

Success brought inevitable problems. Woodbury Common’s growth created traffic challenges that became legendary—and occasionally infamous—in the region.

Black Friday 2001 entered local lore as a traffic disaster. The combination of holiday shopping demand and limited infrastructure created gridlock not just on highways but throughout local roads. Motorists reported being trapped in the center’s internal roads for hours. Local residents and town officials pressed Simon and state police for solutions.

Black Friday 2007 saw similar chaos during the center’s second annual “Midnight Madness” event. Traffic backed up 15 miles north on the New York State Thruway to Newburgh. The sheer volume overwhelmed existing road capacity.

Labor Day weekend 2006 created another traffic nightmare when weather cleared just in time for back-to-school shopping. Route 6 became parking lot-like all the way to the Palisades Interstate Parkway.

These incidents prompted coordinated response strategies:

- Joint command center: State troopers, Woodbury police, and mall officials monitoring traffic in real-time during peak periods

- Traffic management plans: Coordinated signal timing and traffic flow adjustments

- Infrastructure improvements: New York State Department of Transportation invested $30 million in traffic redirection projects

- The parking garage: The 2015 parking deck helped, though peak days still create challenges

The traffic situation illustrates a fundamental truth: Woodbury Common’s success exceeded anyone’s initial projections. The center grew faster and attracted more visitors than 1980s infrastructure could support.

The Retail Evolution: What’s Changed, What Hasn’t

The outlet model itself evolved significantly during Woodbury Common’s four decades. Early outlets focused primarily on overstock and prior-season merchandise from department stores and brand manufacturers. Today’s Premium Outlets model includes:

- Brand-specific stores: Many luxury brands now operate dedicated outlet stores rather than selling through multi-brand outlets

- Outlet-specific merchandise: Some items manufactured specifically for outlet channels (a shift that has generated consumer discussion)

- Luxury escalation: Ultra-luxury brands (Prada, Gucci, Burberry, Celine) that once avoided outlets now maintain high-profile presence

- Experience focus: Enhanced food courts, seating areas, landscaping—outlet shopping as destination experience rather than utilitarian bargain hunting

Woodbury Common led many of these shifts, using its scale and visitor numbers to attract brands that might have been skeptical of the outlet format.

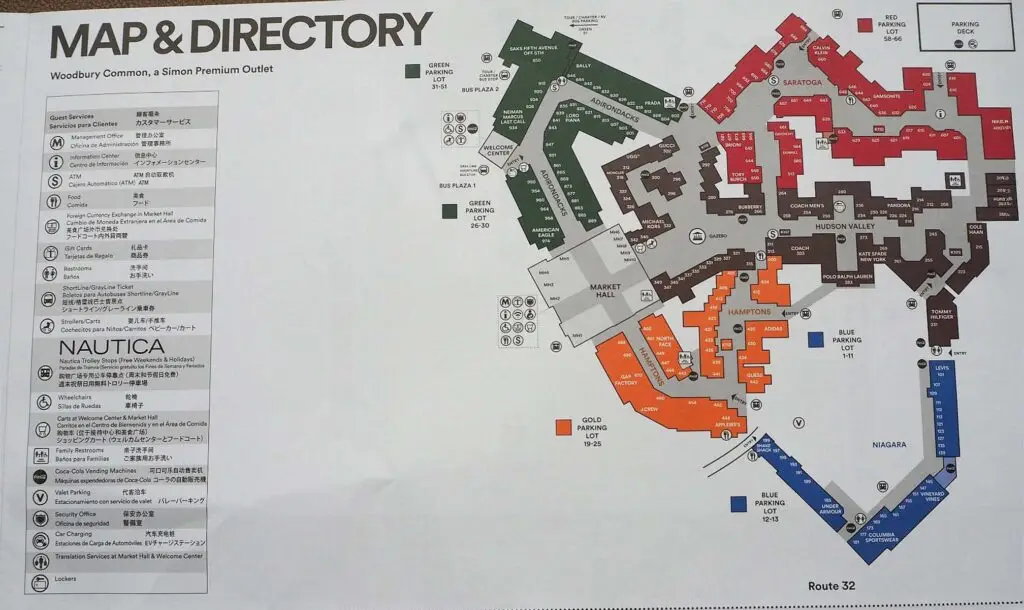

The Color-Coded Navigation System

One practical innovation born from necessity: Woodbury Common’s size created wayfinding challenges that traditional mall directories couldn’t solve. The solution became iconic—color-coded areas throughout the center.

Different sections received distinct colors (Red, Blue, Purple, etc.), with parking lots, directories, and signage using this color system. First-time visitors receive maps showing these zones. Regular shoppers learn to navigate by color: “Meet me at the Blue section near Coach.”

This system, mundane as it seems, became necessary infrastructure. At 912,000 square feet spread across multiple buildings and parking areas, without color coding, visitors would struggle to navigate or relocate their cars.

Looking Forward: What’s Next for Woodbury Common

The 2024 expansion marked the latest chapter in Woodbury Common’s continuous evolution, but Simon Property Group’s ambitions extend beyond the current footprint. While the 155,000 square feet of new retail space and over 20 new stores opened successfully in 2024, several major infrastructure projects remain on the horizon.

Confirmed future developments:

- 200-room hotel: Currently in planning and permitting stages, projected for completion in late 2025 or early 2026. This represents a fundamental shift—transforming Woodbury Common from pure day-trip destination to potential multi-day resort experience.

- Expanded parking facilities: Additional parking infrastructure to support the hotel and continued visitor growth

- Family play areas: Enhanced amenities for families with young children, recognizing the growing demographic of multi-generational shopping trips

- Continued infrastructure improvements: Ongoing traffic flow enhancements and wayfinding upgrades

The hotel project, in particular, signals strategic repositioning. International tourists currently face the challenge of daily shuttle trips from Manhattan hotels. An on-site hotel would allow visitors to shop across multiple days without transportation logistics, potentially increasing per-visitor spending and extending regional tourism impact.

Economic projections for ongoing expansions estimate approximately 1,000 new jobs and an additional $22.51 million in annual retail sales taxes (including $12.10 million for Orange County), building on Woodbury Common’s already substantial economic contribution to the region.

The Broader Context: Outlet Shopping’s American Story

Woodbury Common’s history mirrors the rise of outlet shopping as an American retail phenomenon. Factory outlets existed for decades, but the 1980s and 1990s saw transformation into destination shopping centers.

The concept appealed across economic strata—bargain hunters found deals, while luxury shoppers accessed high-end brands at accessible prices. This democratization of designer shopping, combined with the experience of large-scale outdoor shopping centers, created a uniquely American retail format that eventually spread internationally.

Simon Property Group, through properties like Woodbury Common, led this evolution. The company’s 2004 acquisition of Chelsea Premium Outlets consolidated the outlet sector, creating a portfolio that now spans continents.

Cultural Impact and Pop Culture

Beyond economics, Woodbury Common entered cultural consciousness. International guidebooks list it as a New York attraction alongside the Statue of Liberty and Times Square. Asian travel blogs dedicate extensive coverage to shopping strategies and brand recommendations.

The center represents American consumer culture to international visitors—the scale, the brands, the pricing structure all feel distinctly American. For some, visiting Woodbury Common becomes as much cultural experience as shopping trip.

Personal Reflections: Witnessing the Evolution

Having covered Woodbury Common shopping strategies since 2014, I’ve watched certain shifts firsthand. The 2015 parking garage dramatically improved busy-day experiences. Market Hall’s 2018 opening meant visitors could finally get decent coffee and lunch without leaving the property. The 2024 expansion brought a noticeable elevation in the luxury quotient—brands like Maison Margiela and David Yurman signal Woodbury’s continuing march upmarket.

The international visitor mix continues evolving. Pre-pandemic, Chinese tour groups dominated weekdays. Post-2020, the visitor demographic spread more evenly, though international tourism has gradually returned. The addition of Ladurée—a Parisian institution—in 2024 particularly resonates with international shoppers familiar with the brand from their home countries.

What hasn’t changed: the center’s fundamental appeal. Savings on luxury brands attract shoppers regardless of economic conditions. During every visit, I watch people discover deals that validate the trip—whether they drove an hour from New Jersey or flew from São Paulo. The 2024 additions simply expanded the definition of “luxury” available at outlet prices.

The Statistics That Tell the Story

From 1985 to Today:

- Retail space: Original ~200,000 sq ft → Current 1,067,000+ sq ft (433% increase) Note: includes 155,000 sq ft from 2024 expansion

- Store count: Original ~50 stores → Current 270+ stores (440% increase) includes 20+ new stores from 2024

- Parking capacity: Original surface lots → Multi-level garage plus expanded lots (5,700+ spaces, with additional capacity planned)

- Annual visitors: Estimated 1-2 million (1980s) → 13 million (current) (650%+ increase)

- Employment: Hundreds (1985) → Thousands (current) of retail jobs, with ~1,000 additional positions projected from ongoing expansions

Why History Matters for Today’s Shopper

Understanding Woodbury Common’s evolution helps explain what you experience today:

- The layout: The seemingly random organization reflects decades of additions rather than unified planning

- The international infrastructure: Currency exchange and interpreters exist because of sustained international visitor patterns

- The traffic challenges: Peak-period gridlock results from growth that exceeded original infrastructure planning

- The brand mix: Four decades of relationship-building brought luxury brands initially skeptical of outlet retail

- The amenities: Enhanced food courts and seating areas represent responses to visitor feedback over decades

Sources and Further Reading

This history draws from multiple sources including:

- Orange County Chamber of Commerce records and announcements

- Simon Property Group corporate history and press releases

- New York State tourism economic impact studies by Oxford Economics

- Orange County economic development reports

- Historical news coverage from Times Herald-Record and other regional publications

- Town of Woodbury official records

- Direct observation and documentation during regular visits 2014-2025

For current shopping information: Visit our complete Woodbury Common shopping guide

For area attractions: See our Orange County tourism guide

Historical information compiled from public records, news archives, corporate announcements, and economic reports. Specific dates and figures sourced from Simon Property Group, Orange County government, and New York State tourism data. Current visitor statistics and economic impact figures represent most recent available data as of 2023-2024.